Click Here to View the HRSA Health Center Facility LGP Toolkit for Health Centers

Click Here to View the HRSA Health Center Facility LGP Instructions

What is the HRSA Health Center Facility Loan Guarantee Program (LGP)?

Originally authorized by Congress in 1997, the HRSA Health Center Facility Loan Guarantee Program (LGP) offers loan guarantees for the construction, renovation and modernization of medical facilities operated by health centers. The guarantee can cover up to 80% of the principal amount of loans made by non-federal lenders. Congress appropriated new funds for the program in 2018, enabling HRSA to update and modernize the program to provide guarantees for almost $900 million in new loans to health centers.

How can the LGP benefit my health center?

Many health centers face challenges obtaining affordable loans for their capital projects and/or experience delays in securing loans because of credit or collateral shortfalls. These factors can result in protracted development schedules and higher costs for capital projects. These delays result in reduced access to care for patients and sub-optimal working conditions for health center staff. A loan guarantee can enhance the health center’s credit profile, reducing the lender’s risk and allowing them to lend to health centers under more favorable terms than would have been possible otherwise. For some centers, the guarantee might mean the difference between getting a “yes” or a “no” from a lender, while for others, it may allow the lender to offer a lower interest rate, a longer fixed-rate term, or a higher loan-to-value ratio.

What types of organizations are eligible for the LGP?

Health Center Program awardees are eligible for the LGP. Look-alikes and other types of clinics are not eligible. Information on health centers is available here: https://bphc.hrsa.gov/about/what-is-a-health-center/index.html.

What types of lenders can participate in the LGP?

Guarantees are available for loans made by “non-federal lenders.” In practice, this requirement means that most lenders—with the exception of tax-exempt bond issuing authorities—are eligible lenders under the program. Eligible lenders specifically include federally-insured financial institutions, subject to oversight by federal banking regulators, as well as Community Development Financial Institutions (CDFIs), certified by the U.S. Department of the Treasury.

How does the LGP benefit lenders?

The purpose of the HRSA LGP is to enhance the health center’s credit profile, reducing the lender’s risk to allow the lender to provide a loan under more favorable terms than would have been possible otherwise.

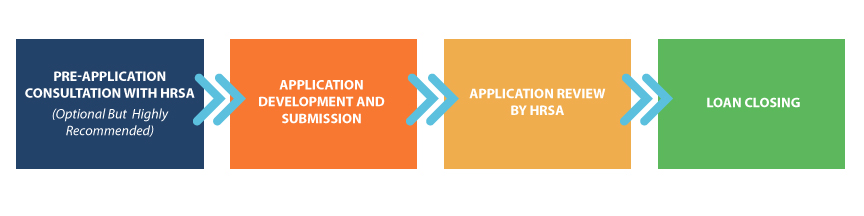

What is the process for applying for a Loan Guarantee?

There are four phases to the LGP application process:

What is the typical time frame for HRSA to review a LGP request?

Once a complete application package is submitted, including a loan commitment from an eligible lender, HRSA will generally make a determination of approval or disapproval within 60-90 days.

How is the guarantee structured and what are its terms and conditions?

Summary Terms and Conditions of HRSA Loan Guarantee and a Form of Guarantee will be available at https://bphc.hrsa.gov/programopportunities/loan-guarantee-program.html

What types of projects are eligible?

Examples of eligible projects include, but are not limited to:

-

Building a new facility to provide the full scope of health center services

-

Renovating a facility for administrative offices or a call center

-

Constructing an addition to an existing facility to provide space for a wellness center

What are typical costs associated with a project that can be supported through the LGP?

-

Land and building purchases

-

Renovation and new construction costs

-

Equipment and “fit out” costs

-

Limited refinancing of existing debt

-

Capitalizable pre-development costs

-

Financing and consultant fees

-

Capitalized interest during construction

-

Limited working capital during a start-up phase

While land and equipment purchases are eligible costs, they will be allowed only as part of a construction, renovation, or modernization project.

What factors should I consider in choosing a lender?

A health center should carefully evaluate its lender options, considering such factors as interest rate, term, amortization, covenants and other requirements. Other important considerations include the quality of the working relationship, the reputation of the lender, its experience with the LGP and the availability of New Markets Tax Credits, if applicable.

Can the LGP be utilized in conjunction with other federal loan programs, such as the New Markets Tax Credit Program?

Yes, the LGP may be used in conjunction with New Markets Tax Credits, although it may not be used in conjunction with tax-exempt bonds.

Does HRSA charge a fee for the guarantee?

HRSA does not currently charge a fee for the LGP.

What technical assistance resources are available to help me or my prospective borrower through the application process?

HRSA has designated a Lender Coordinator to act as a resource for lenders considering participating in the program. Questions should be routed through HRSA via LGP inbox: This email address is being protected from spambots. You need JavaScript enabled to view it.. Lender Coordinator connection is arranged by HRSA referral.

As HRSA’s National Cooperative Agreement (NCA) partner, Capital Link can provide a range of technical assistance to health centers applying to the LGP. From early-stage project planning, to developing a business plan and financial projections, to identifying and negotiating with lenders, and structuring New Markets Tax Credit transactions in conjunction with the LGP, Capital Link is available to help. For assistance, contact Beth Edwards at This email address is being protected from spambots. You need JavaScript enabled to view it..

Resources

HRSA Health Center Facility Loan Guarantee Program: A Handbook for Lenders

HRSA Health Center Facility Loan Guarantee Program: A Handbook for Lenders

The HRSA Facility Loan Guarantee Program (LGP) is a valuable tool for health centers that involves the participation of private sector lenders working in collaboration with HRSA to bring much needed capital with affordable rates and attractive terms to the non-profit sector. This handbook serves as a resource for lenders as they seek to utilize the program in conjunction with loans to eligible health centers. (Released in 2023)

HRSA Health Center Facility Loan Guarantee Program Toolkit:

HRSA Health Center Facility Loan Guarantee Program Toolkit:

Application Tips and Tools for Health Centers

Developed with support from HRSA, the Health Center Facility Loan Guarantee Program Toolkit provides health centers with a detailed outline for preparing a capital project, collecting the materials needed to submit a LGP application, and tips to help navigate the application process efficiently. (Released in 2020)

HRSA Loan Guarantee Program - An Overview for Health Centers

This fact sheet provides details about the HRSA Health Center Facility Loan Guarantee Program (LGP) for health centers. (Updated in 2023)

HRSA Loan Guarantee Program - An Overview for Lenders

HRSA Loan Guarantee Program - An Overview for Lenders

This fact sheet describes the details of the HRSA Health Center Facility Loan Guarantee Program (LGP) for lenders. (Updated in 2023)