After 28 years leading the non-profit organization Capital Link and its lending affiliate, Community Health Center Capital Fund, Allison Coleman today announced plans to retire at the end of June. As a co-founder of Capital Link, Coleman’s vision and leadership have contributed to the impressive growth of community health centers both in Massachusetts and nationally over nearly three decades.

“When I started at Capital Fund back in 1994 as its first and only staff person, I’m not sure I really knew what I was getting into—but I quickly fell in love with the scrappy, determined, mission-focused health centers in Boston, who were on the cusp of a growth surge that would shortly be replicated by community health centers all across the state and country. The need for capital was as apparent then as it is now,” says Ms. Coleman.

In the late 1990s, with the support of the Massachusetts League of Community Health Centers, Neighborhood Health Plan, the National Association of Community Health Centers (NACHC), and several other state Primary Care Associations (PCAs), Ms. Coleman began an experiment to build out a then very small, Massachusetts-based capital program for Federally Qualified Health Centers (FQHCs) and make it available nationally. With the help of the Health Resources and Services Administration’s Bureau of Primary Health Care, Capital Link was born.

Today, Capital Link works with FQHCs nationwide helping them plan for growth, access capital, improve and optimize operations and financial management, and articulate their value. As Capital Link’s lending affiliate, Capital Fund is a certified Community Development Financial Institution and makes New Markets Tax Credit investments and direct loans to health center to assist them in leveraging multiple sources of financing for their capital projects.

Since Capital Link’s founding, health centers have expanded from approximately 575 health center corporations serving 6.8 million patients to more than 1,400 FQHCs operating almost 14,000 sites and serving 29 million patients today. Capital Link and Capital Fund have played a supporting role in this tremendous growth, including:

- Assisted more than 1,100 health centers with various aspects of capital planning, helping them go from “dream to reality”;

- Developed the first tax-exempt bond program for health centers in the country for Massachusetts health centers utilizing guarantees from Boston teaching hospitals;

- Directly leveraged more than $1.3 billion for hundreds of health center capital projects through one-on-one financing assistance;

- Pioneered the use of New Markets Tax Credit (NMTC) financing for health centers, beginning with the first NMTC financing for Holyoke Health Center in 2005. Since that time, health centers have obtained close to $4 billion in NMTC financing—$880 million of this amount with Capital Link assistance;

- Developed Capital Fund as a Community Development Financial Institution (CDFI), making direct loans totaling $167 million and NMTC investments totaling $130 million for health center projects;

- Conducted and published numerous capital needs assessments, financial and operational trends analyses, and impact analysesthat have helped to make the case for more than $4 billion in federal capital grants and untold millions from states and foundations in support of health center capital needs;

- Assisted health centers in strengthening their operations through use of benchmarking and comparative financial and operating metrics;

- Worked collaboratively with NACHC, 21 National Training and Technical Assistance Partners, and PCAs nationwide offering trainings and analyses to support health center growth and development;

- Offered numerous Learning Collaborativeson a range of topics related to growth planning and capital development;

- Worked with partner CDFIs and NACHC to revitalize and improve the HRSA Health Center Facility Loan Guarantee Programas a critical tool for improving health center access to capital;

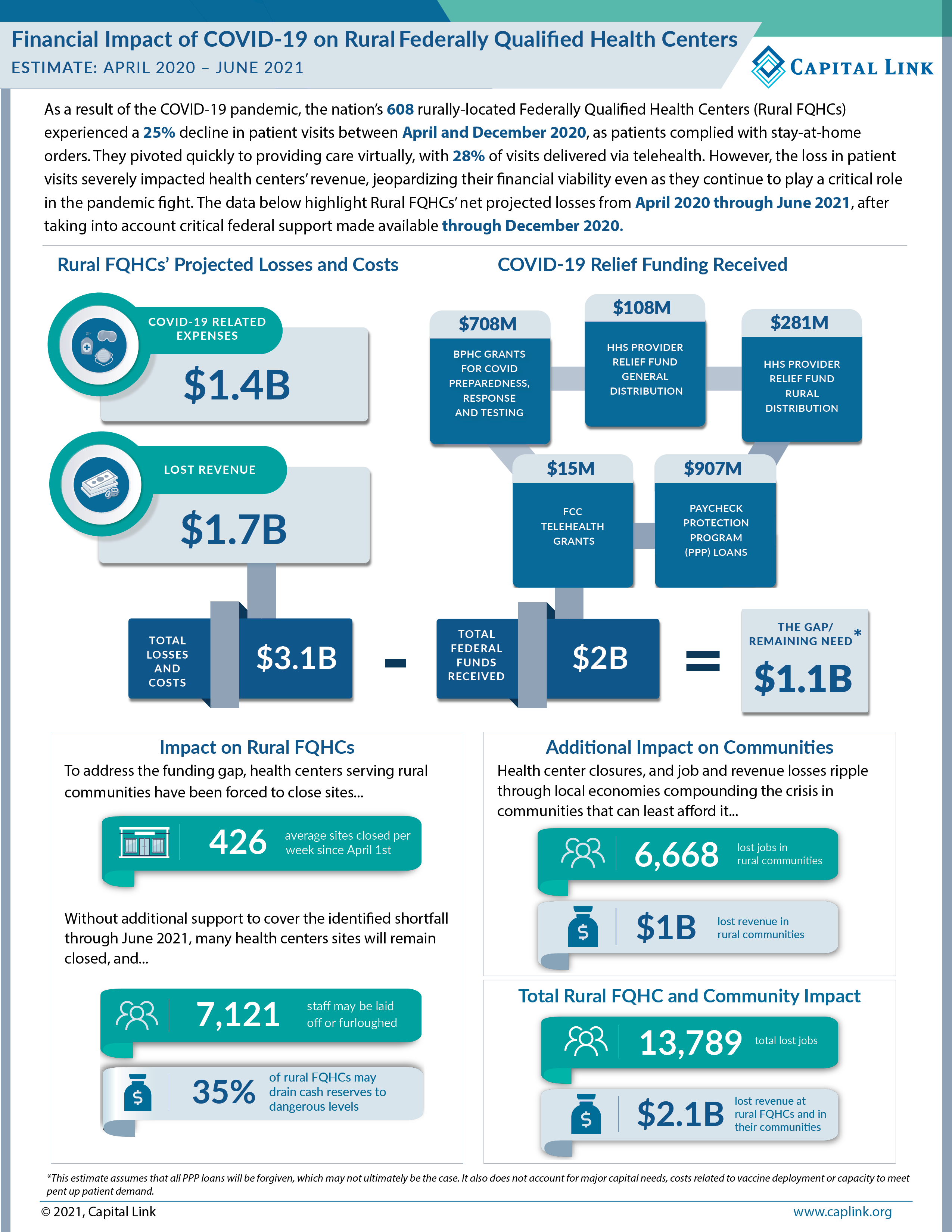

- Analyzed the financial impact of COVID-19on health centers, documenting the need for federal support to help health centers survive the pandemic and provide critical support to our communities nationwide;

Michael Curry, President and CEO of the Massachusetts League of Community Health Centers and board member of Capital Link and Capital Fund, stated, “Allison will be greatly missed. As the foremost expert on health center capital finance in the country, she has helped health centers grow to meet this moment. The boards are committed to finding a great candidate to build on her extraordinary legacy, continuing the effort to leverage the capital needed for health center growth here in Massachusetts and across the country.”

Rachel Gonzales-Hanson, Interim President and CEO of the National Association of Community Health Centers and a Capital Link board member, added, “Allison’s team has guided health centers to think ‘bigger’ and not be so intimidated by growth and financing. Her work helped evolve many health centers from ‘poor people’s clinics’ to business-minded companies that held true to their mission as they built buildings and created business plans. She has focused on educating bureaucrats, foundations, bankers, lending institutions, and so many others to see the value of investing in health centers. She has opened doors for individuals from throughout the health center movement to join her team and share their expertise and knowledge. She changed the trajectory of so many health centers and patient lives—more than she will ever know. We will really miss her, but wish her well on her next adventure.”

Capital Link and Capital Fund are beginning the year stronger than ever—programmatically and financially, and with a steadfast commitment to supporting the growth of the FQHC sector. “I am excited to see what a new leader will bring to this endeavor, building upon such a solid base,” says Ms. Coleman.

The Boards of Capital Link and Capital Fund have engaged Koya Partners the executive search firm that specializes in leading mission-driven searches at the senior level, to conduct a national search for Ms. Coleman’s successor. If you are interested in the opportunity, or would like to recommend a potential candidate, please contact the Koya search team: Erin Reedy, This email address is being protected from spambots. You need JavaScript enabled to view it. or Kim Dukes, This email address is being protected from spambots. You need JavaScript enabled to view it.. View the position profile here.