New and Noteworthy

The HRSA Health Center Facility Loan Guarantee Program

Originally authorized by Congress in 1997, the HRSA Loan Guarantee Program (LGP) offers loan guarantees for the construction, renovation, and modernization of medical facilities operated by health centers. Authorized under Part A of Title XVI of the Public Health Service Act, the guarantee can cover up to 80% of the principal amount of loans made by non-federal lenders. In 2018, Congress appropriated new funds for the program, enabling HRSA to update and modernize it to provide guarantees for almost $900 million in loans to health centers going forward.

The purpose of a loan guarantee is to enhance the health center’s credit profile, reducing the lender’s risk and allowing it to lend to health centers under more favorable terms than would have been possible otherwise. For some centers, a loan guarantee could mean the difference between getting a “yes” versus a “no” from a lender, while for others, it may allow the lender to offer a lower interest rate, a longer fixed-rate term, or a higher loan-to-value ratio, or other benefits.

While the details of the new program are still being finalized, Capital Link is working closely with HRSA to provide a range of trainings and assistance on the program to health centers and lenders.

In addition to offering trainings on the LGP, with support from HRSA, Capital Link can directly assist a limited number of health centers with preparing program application materials. Funding for this assistance is limited, so please contact Jonathan Chapman, Director of Community Health Center Advisory Services, at This email address is being protected from spambots. You need JavaScript enabled to view it. as soon as possible.

Learn more about the LGP, as well as the New Markets Tax Credit (NMTC) program, at our upcoming webinar:

Health Center Capital Project Financing Sources: HRSA’s LGP and NMTC

Thursday, June 20, 2019, 2:00 pm - 3:00 pm EDT

Presenters: Allison Coleman, CEO

Access the recordings/slides of our recent webinars, Demystifying HRSA’s Loan Guarantee Program, a two-part webinar series sponsored by NACHC:

Part I: HRSA's Loan Guarantee Program Explained

Presenter: Allison Coleman, CEO

Slides | Recording

Part II: HRSA's Loan Guarantee Program Q&A

Presenters: Allison Coleman, CEO, and Capital Link Health Center Advisory Services team members

Slides | Recording

We will also provide trainings at several upcoming regional NACHC and State PCA conferences, including:

NACHC Elevating Health Center Operations (EHCO)

Thursday, June 13, 2:45-3:45 pm

Portland, OR

Presenter: Jonathan Chapman, Director of CHC Advisory Services

Please continue to check Capital Link’s website and HRSA’s LGP webpage for new information on the program as it becomes available.

25th Anniversary Highlights

Leveraging Capital Planning Resources for Growth and Performance Improvement

Over our long history, we’ve discovered that many of the tools and resources we developed to assist health centers with capital planning when Capital Link was first established are also useful for other initiatives. In particular, many of our resources can be used for growth planning and operational and financial performance improvement, whether or not a health center is planning a capital project.

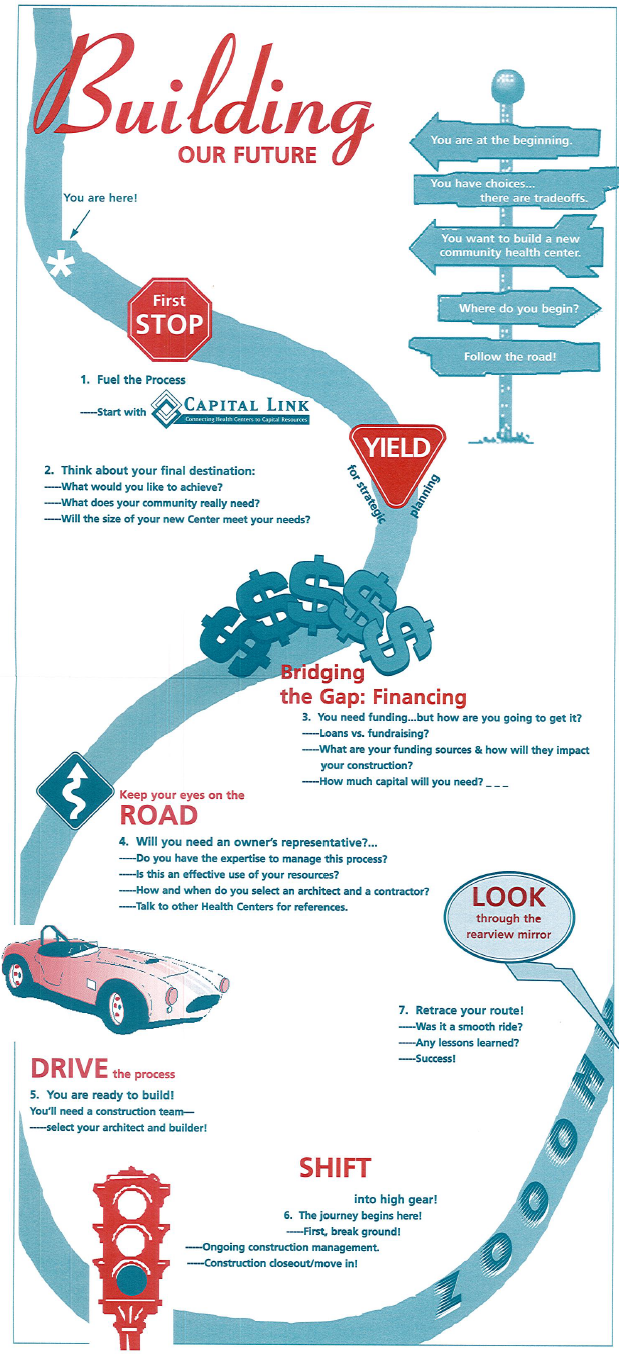

In one of our early campaigns, Building Our Future, we explained that for a capital project you need a compelling community need to support the case for investment. And that you might identify that need by conducting a market analysis and documenting the community impacts of meeting the need by doing a value and impact analysis. These analyses are also needed for successful growth planning and performance improvement. Health centers need to demonstrate a compelling community need to support the case for growth and to provide the impetus for performance improvement—making a market assessment and impact analysis very useful in these contexts too.

The next step is to create a road map that responds effectively to the community need. In a capital planning context, the road map might be called a business plan, coupled with a “master facilities plan.” In a growth planning context, you’d call it a strategic plan. In a performance improvement context, you’d call it a business plan or, perhaps, a “corrective action plan.”

Whether you are undertaking a capital project or seeking to grow or improve, you need strong initial operations, a strong operational plan, and achievable targets based on best practice benchmarks. You also need strong financial performance, as demonstrated through historical and projected financials. And, of course, capital project success and successful growth and improvement are always dependent upon strong leadership across the organization.